The Work Order Network recognizes and reports on the three types of sales tax levied in Canada:

(1) Provisional Sales Tax (PST)

(2) Good and Services Tax (GST)

(3) Harmonized Sales Tax (HST)

If taxes are added to an invoice for a job under a Canadian address, Service Providers will be forced to indicate the tax classifications from one of the three options listed above. Multiple tax line items can be added to a single invoice, and the example below provides an example of the overall process.

When a work order has a Canadian Address, such as the example below,

Figure 1: Detail of Work Order

…the invoice tax feature has special behavior, whereby adding tax forces the user to select from one of the Canadian taxing options: GST, PST or HST, as seen below.

Figure 2: Adding tax on an invoice for a Canadian location

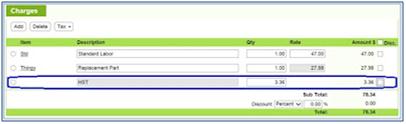

Like any other tax in the WorkTrack Service Provider system, the user must self-calculate the amount and plug it in to the amount edit box as shown below.

Figure 3: Tax line item

Two or three different types of tax may be recorded in the same invoice as seen in the example below.

Figure 4: Invoice with 2 types of tax collected

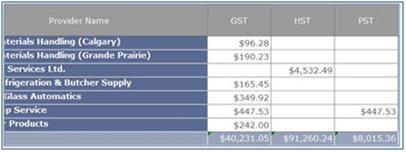

Taxes then can be reviewed globally through reports as seen in the report detail shown below.

Figure 5: detail of a report showing taxes collected by service provider

You must be logged in to post a comment.